The idea of moving into an apartment for the first time is an exciting one. You get to look for your own furniture and decorations, have parties whenever you feel like it, and enjoy more privacy. However, with this new sense of freedom comes a whole lot of financial responsibility.

There are many aspects of finding the right apartment that can be tedious and time consuming, but they are vital to ensuring that you find a place that will make you feel comfortable after a long day of work.

With freedom comes many decisions

When looking for apartments, you have to consider elements like location and neighborhood, the size of the apartment, its amenities, and whether or not you want roommates.

One of the most important pieces of this puzzle, however, is actually figuring out what you can afford.

One of the most important pieces of this puzzle, however, is actually figuring out what you can afford.

While you want to find a place that has all of the amenities you want, you also have to remember that aside from paying your monthly rent, you may have other expenses like groceries, gas, a car payment, utilities, and paying off student loans.

With this being your first apartment, you might need some time to transition to handling all aspects of your own life, including handling mundane day-to-day necessities like cleaning your apartment, doing laundry, and preparing food for yourself.

With the right tools, budgeting can be a breeze

You'll also need to start figuring out your own finances, which can be difficult for those who are just starting out, or who have had trouble in the past with managing their finances correctly. The good news, though, is there are many different ways you can make budgeting easy and have it become second nature to you. You'll never have to sweat about making a payment again!

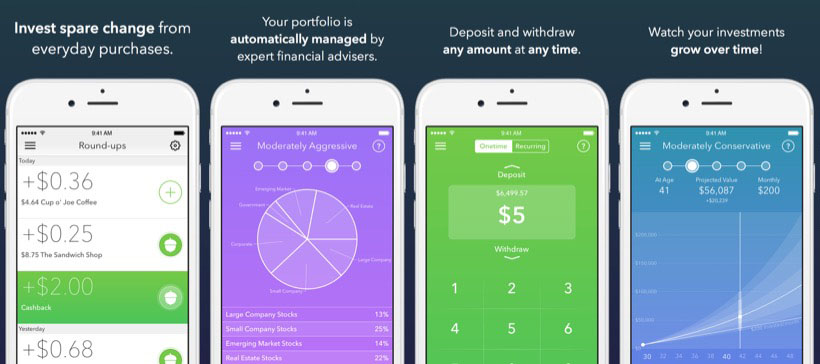

1. Download the Acorn app to save loose change

Are you a fan of picking up a cup of coffee before you head to work in the morning? With the Acorns app, the loose change you get back after ordering will be rounded to the nearest dollar and then invested into stocks and bonds. Which means, not only are you putting money aside for savings (that spare change can really add up!), but you have the chance to make a pretty penny on those investments.

The best part? You don't have to be a Wall Street advisor to do well in the market. The team behind the app will find the best mix of stocks and bonds for you to ensure there is lowered risk and a higher chance of return on your investment. Investments that are too aggressive in nature can (sure, bring in some good money is the stocks are doing well) really cost you in terms of losses.

2. Shop around when choosing internet plans

Before you sink your money into an internet plan, be sure to shop around on the internet and even reach out to friends and family to see if they know of any great deals. If you've already chosen a service, doesn't worry! You can use the Trim app to help bring down your monthly payments. Trim negotiates your price for you, so you can start paying less for internet and cable.

3. Don't pay for cable (unless you really need to)

If you're not in dire need of cable, try choosing a subscription service instead, like Amazon Prime Video, Netflix, or Hulu, for about $10 a month. These streaming services let you enjoy a good amount of movies and TV shows without having to be locked into an expensive cable service, and you can enjoy it on your phone, tablet, computer, or TV.

4. Opt out of a gym membership

While a membership to a certain service might seem low at the time, having to pay it monthly, on top of other expenses, can quickly add up. Instead of having to pay for a $10-$50 gym membership, trying going for a walk or run at the park. Round up some friends and play basketball at a local park or check into community events like free yoga. If you need extra motivation download the free 7 minute workout app.

5. Set up reminders

In order to avoid missing payments (and then having to add on late fees), set reminders on your phone or set up automatic payments via the online portal for each credit card, your rent, utilities, and any other recurring expenses. Most major credit card companies allow you to schedule a minimum payment to go out automatically, which ensures you don't pay any fees and keeps your credit score intact (woo!).

Find a solid rewards credit card to make the most of all of these expenses, and consider paying rent and other expenses with Plastiq to increase your reward earnings.

6. Bring meals from home to work

It's easy to get swayed into wanting to head to Chipotle for lunch with your coworkers, but taking your lunch from home can end up savings you a lot of money. You can make a cheap meal that can last three days for the same price you pay for a burrito bowl. If you are going out regularly, consider buying discount gift cards to save 5-20% on every meal.

7. Get some (digital) help

Still need money help? There's an app for that! From saving, to borrowing, to cashback shopping, there are many free money apps that can make living on your own easier. Here are a few to check out:

- Qapital automates your savings.

- Circle and Square Cash both make it easy to send money and split bills – plus they both offer a sign up and referral bonus!

- MoneyLion gives you access to short-term loans with a very low interest rate.

- Credit Sesame monitors your credit score.

- The Earnin App iPhone and Earnin App Android allow you to borrow from your next paycheck for free.

- Spent App tracks your expenses and offers cash back.

- Stockpile and Robinhood make it easy to invest in stocks.

- Acorns, Stash, Betterment, and M1Finance make it easy to automate your investments.

- Ebates, Ibotta, and Checkout51 let you earn cashback on everyday spending.

- Drop gives you automatic cashback from hundreds of stores when you connect your credit cards (no purchase necessary).

- Coinbase provides a platform to buy and sell Bitcoin and other cryptocurrencies.

The true costs and responsibilities associated with moving into your own place can be very surprising. By planning ahead, and making the most of technology, you can make the ultimate transition into “adulthood” successful for you and your wallet.